Table of Contents

- Australia Income Tax Calculator 2025

- Australian Tax Brackets in 2024 - Tax Basics for Beginners - YouTube

- Australian income tax brackets and rates (2024-25 and previous years)

- Australian Income Tax Rates 2024-25 - Rafa Ursola

- Understanding the Australian tax system 2025

- Australian Tax Brackets 2024 Archives - KPG Taxation | Tax Accounting ...

- Australia Weekly Tax Table 2024: How To Check Withholding Amount? – Ambt

- New Tax Rates Australia 2024 Calculator - Printable Forms Free Online

- 2024 Australian Tax Bracket Changes - Cosca

- Navigating the Australian Tax Brackets in 2024: A Comprehensive Guide

What are Tax Brackets?

Tax Brackets 2024-2025: What's New?

How Do Tax Brackets Work?

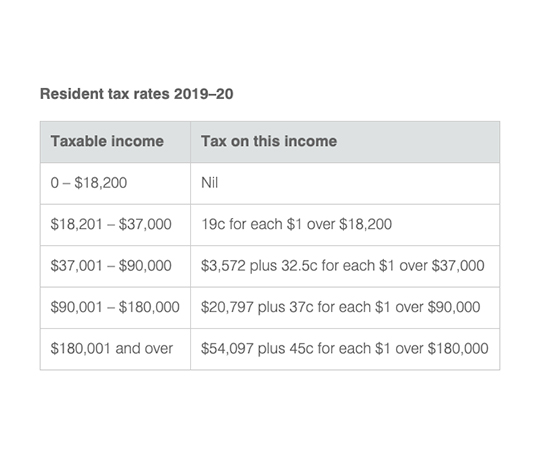

Tax brackets work by applying a specific tax rate to each range of income. For example, if you earn $50,000 per year, you'll pay a certain tax rate on the first $18,201 (tax-free threshold), and a higher tax rate on the amount above $18,201. The tax rates for each bracket are as follows: 19% on taxable income between $18,201 and $45,000 32.5% on taxable income between $45,001 and $120,000 37% on taxable income between $120,001 and $180,000 45% on taxable income above $180,000

Expert Advice from Money Magazine

According to Money Magazine, it's essential to understand how the tax brackets work and how they may impact your financial situation. "Tax planning is crucial to minimizing your tax liability and maximizing your refunds," says a tax expert from Money Magazine. "By staying informed about the latest tax brackets and changes, you can make informed decisions about your finances and ensure you're taking advantage of all the tax deductions and credits available to you." In conclusion, understanding the tax brackets for 2024-2025 is essential for managing your finances and minimizing your tax liability. By staying informed about the latest updates and changes, you can make informed decisions about your taxes and ensure you're taking advantage of all the tax deductions and credits available to you. Whether you're a seasoned taxpayer or just starting to navigate the complex world of taxes, this guide has provided you with valuable insights and expert advice from Money Magazine. Remember to consult with a tax professional or financial advisor to ensure you're getting the most out of your tax return.For more information on tax brackets and tax planning, visit Money Magazine or consult with a tax professional.